Compound interest calculator increasing contributions

I P. A P 1 rn nt.

Walletburst Compound Interest Calculator With Monthly Contributions

This calculator will help you to determine the future value of a monthly investment at various compounding intervals.

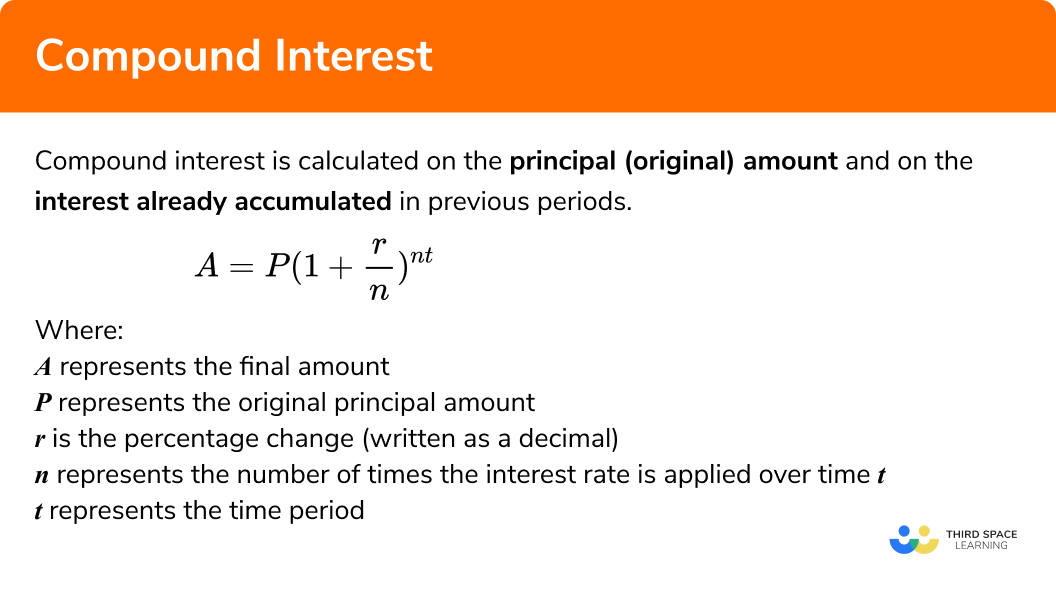

. Please refer to the Compound Interest Calculator to convert between APY and APR or interest rates of different compounding frequencies. This is the simple compound interest formula including initial deposit. To calculate only the compound interest portion CI the above formula can be modified by subtracting the initial principal P.

Use this compound interest calculator to illustrate the impact of compound interest on the future value. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. To calculate the total compound interest generated we need to subtract the initial principal.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Compound interest can have a dramatic effect on the growth of an investment. Compound interest can have a dramatic effect on the growth of an investment.

Ad Calculate the impact of dividend growth and reinvestment. Still one thing is very sure that you will be earning. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

To calculate the future value of a monthly. Visit The Official Edward Jones Site. To begin your calculation take your daily interest rate and add 1 to it.

CI is the compound interest earned. Discover Bank Member FDIC. Ad Ready to Start Saving.

The speed of your money increment depends on your compounding period. Build Your Future With a Firm that has 85 Years of Investment Experience. Compound interest calculator increasing contributions.

Use this compound interest calculator to illustrate the impact of compound interest on the future value. We can generalize above steps to create simple formula for capital worth after n years. Use this compound interest calculator to illustrate the impact of compound interest on the future value.

The compound interest formula above assumes that the interest calculation occurs before the regular deposit is added on and does not account for all mathematical and financial theory. If you initially had 5000 saved up. Open an Online Savings Account today.

This phenomena is known as compound interest or colloquially and more general snow ball effect. Daily compound interest is calculated using a simplified version of the formula for compound interest. Build Your Future With a Firm that has 85 Years of Investment Experience.

New Look At Your Financial Strategy. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Compare our Rates See the Difference.

Compound interest can have a dramatic effect on the growth of an investment. Get Maximum Savings with Minimum Hassle.

Compound Interest Formula And Financial Calculator Excel Template

Compound Interest Calculator Daily Monthly Quarterly Annual

Roth Vs Traditional Ira Which One Is A Better Retirement Option For Millennials Find Out Roth Vs Traditional Ira Traditional Ira Ira

Compound Interest Formula And Financial Calculator Excel Template

Compound Interest Calculator Daily Monthly Yearly

Compound Interest Formula And Financial Calculator Excel Template

Compound Interest Excel Formula With Regular Deposits In 2022 Excel Formula Compound Interest Excel

Compound Interest Calculator Daily Monthly Quarterly Annual

Walletburst Compound Interest Calculator With Monthly Contributions

Compound Interest Gcse Maths Steps Examples Worksheet

Compound Interest Formula And Calculator For Excel

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Compound Interest Formula And Financial Calculator Excel Template

How Can I Calculate Compounding Interest On A Loan In Excel

Compound Interest Calculator With Formula

Quick Review Of Irs Changes To Ira And 401k In 2019 Dr Breathe Easy Finance Finance 401k Personal Finance

Budget Pie Chart Money Personal Finance November 2019 Finance Saving Budgeting Emergency Fund