37+ 5 year fixed rate mortgage calculator

337 Sep 13 2022 91322. Adjustable rate mortgages can.

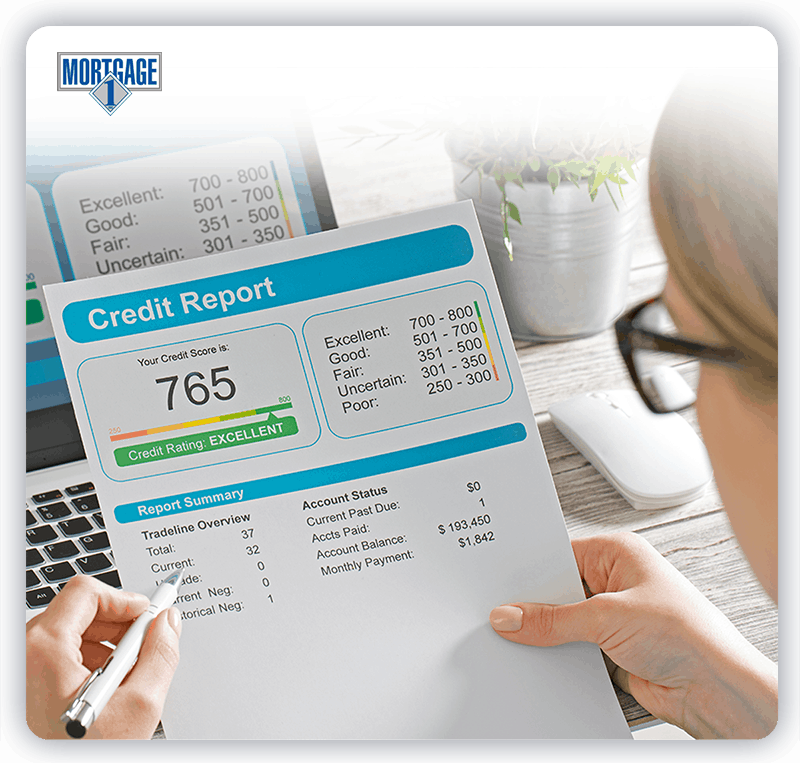

10 Steps Toward Home Ownership Mortgage 1 Inc

A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float.

. The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022. The interest rate charged on the outstanding principal balance does not change month to month guaranteeing. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Thinking of getting a 30-year variable rate loan with a 7-year introductory fixed rate. Todays average fixed rate for a 15-year mortgage is 558 compared to the average of 536 a week earlier.

Check the latest fixed and variable mortgage rates for Scotiabank as of Sep 2022. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. Well find you.

Other rates as low as 549. Well also compare payments between 10-year 15-year and 30-year fixed-rate mortgages. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1078 monthly payment.

If you are paying tax at the rate of 37 15 medicare levy you would receive a tax refund of 9625 per week. If you have the means to make higher monthly mortgage payments a 15-year mortgage. Compare Scotiabank with other top lenders.

Freddie Mac and the National Association of Homebuilders expect mortgage rates to be 3 in 2021 while the National Association of Realtors thinks it will reach 32 and Wells Fargo thinks rates will be 289. Other costs and fees related to your mortgage may increase this number. Special NaN 5-Year Fixed.

A fixed five-year mortgage has also risen from 275 to 424 in just one year The Bank of England increased the base rate to 175 on 4 August Rates are expected to continue rising as the Bank. A 10-year fixed mortgage is a home loan thats paid within a period of 10 years. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily Freddie Mac etc.

207275482 since each adjusts to the 1-year treasury. By the end of the fourth year there is only a 400 difference between the monthly loan payments. Your total interest on a 250000 mortgage.

Thats about two-thirds of what you borrowed in interest. Please get in touch over the phone or visit us in branch. You can therefore claim 250 per week against your income tax.

The fully-indexed rate for the one-year variable-rate mortgage is calculated as the one-year Treasury yield plus the margin. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 47742 a month while a 15-year might cost 73969 a month. Your results would be given below.

Assuming you have a 20 down payment 60000 your total mortgage on a 300000 home would be 240000. Earning a tax refund through negative gearing. The property initially costs you 100 per week out of pocket.

If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage. 7YR Adjustable Rate Mortgage Calculator. Use this calculator to figure your expected initial monthly payments the expected payments after the loans reset period.

The 30-year fixed averaged 331 during the week ending November 21 2012 its lowest point in history. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Only 193 of respondents say the government shouldnt be doing anything.

Freddie Macs Mortgage Rate Statistics Started in 1971. The above table. After your tax refund of 9625 the actual cost is just 375.

A 15-year fixed-rate mortgage has a higher monthly payment but greater overall. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Because both variable-rate products in the survey data use the same margin the fully-indexed rate for the five-year variable-rate mortgage is the same number.

Discover how much you could borrow and what it could cost with our easy-to-use mortgage calculator from Principality Building Society. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Because its a fixed-rate mortgage FRM it maintains the same interest rate for the entire loan duration.

Later the 15-year fixed hit the lowest point ever sinking to 256 during the week ending May 2 2013. Getting ready to buy a home. A 30-year fixed rate mortgage is a home loan structure that establishes an unchanging interest rate throughout the course of the loan.

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. Todays mortgage rates in Texas are 5870 for a 30-year fixed 4965 for a 15-year fixed and 5238 for a 5-year adjustable-rate mortgage ARM. By decreasing the length of the loan from 30 to 15 years your monthly payments increased significantly from the first loanThere is a 700 jump in your monthly payments when comparing both loans at the first 6 months.

Understanding How 10-Year Fixed Mortgages Work.

Hk2ynjjeqz6mam

Outdoor Flatscreen Tv Installation Charlotte Home Theater Installation Projector Surround Wiring T Home Theater Installation Home Theater Furniture Patio Tv

Build A Budget Calculator Clearpoint Credit Counseling Cccs Budget Calculator Budgeting Wedding Budget Calculator

37 Acres Pagosa Springs Co Property Id 9652126 Land And Farm

37 Acres Reno Nv Property Id 10122043 Land And Farm

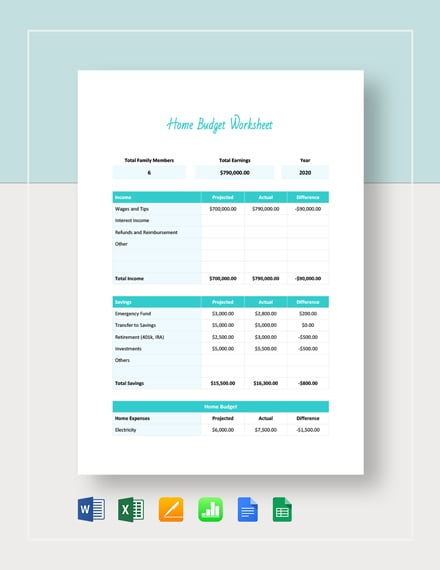

Home Budget Worksheet Template 10 Free Pdf Word Documents Download Free Premium Templates

10 Steps Toward Home Ownership Mortgage 1 Inc

Lacquered Leather Modern Platform Bed With Extra Storage Platform Bedroom Sets Modern Platform Bed Upholstered Platform Bed

Tables To Calculate Loan Amortization Schedule Free Business Templates

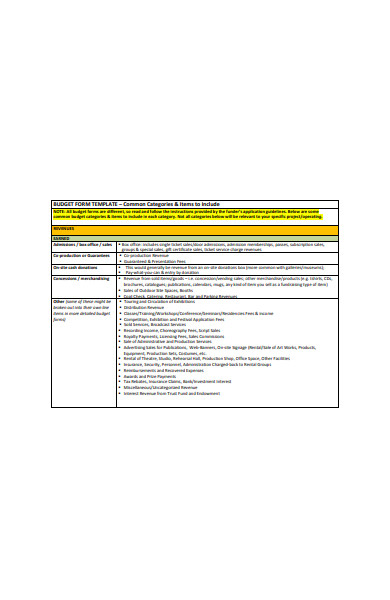

Free 52 Budget Forms In Pdf Ms Word Xls

Tables To Calculate Loan Amortization Schedule Free Business Templates

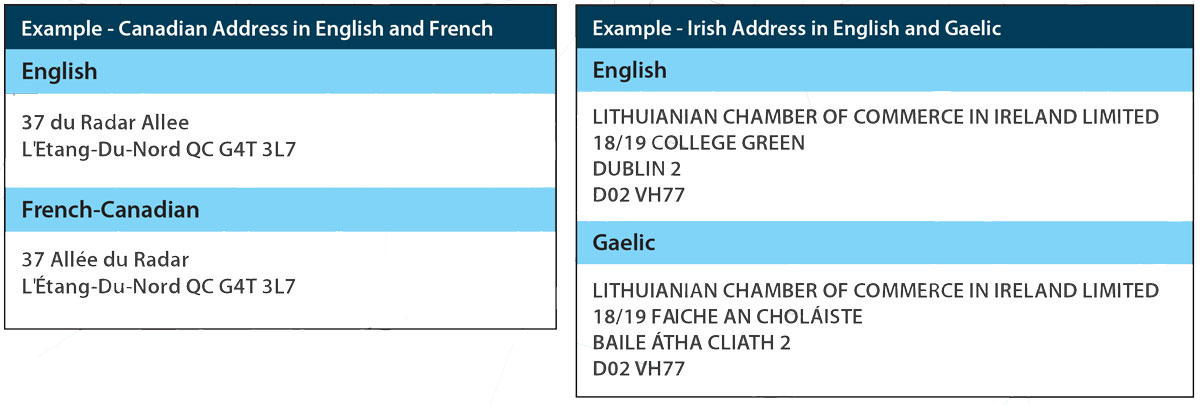

Melissa Address Key Mak Melissa

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Moneycounts A Financial Literacy Series Ppt Download

Tables To Calculate Loan Amortization Schedule Free Business Templates

Vystar Credit Union Review High Interest Rates On Cds